Department of Conservation and Recreation

Department of Conservation and Recreation

Conserve. Protect. Enjoy.

Department of Conservation and Recreation

Department of Conservation and Recreation

By Matt SabasPosted September 30, 2024

Flooding is the most common and costly natural disaster in Virginia. During Atlantic hurricane season (June 1 to November 30), we want to make sure everyone understands the facts about flooding and how to prepare. Our first message is that flooding doesn’t solely impact coastal areas – anywhere it can rain, it can flood.

In recent years, central and western Virginia communities have been inundated by severe storms and heavy rain, flooding roadways and requiring some residents to be rescued from their homes. Southwestern Virginia is just beginning to cope with the aftermath of hurricane Helene, flash floods devastated Lynchburg in 2023 and Buchanan County in 2021 and 2022, and the remains of hurricanes Michael and Florence wreaked havoc across the region in 2018.

The Department of Conservation and Recreation’s Floodplain Management Program collaborates with localities, other state agencies and the Federal Emergency Management Agency (FEMA) to coordinate flood protection programs across Virginia, including the National Flood Insurance Program (NFIP). The NFIP provides flood insurance to homeowners, renters and businesses which offers an essential financial lifeline after a flood.

Only 3% of Virginians currently maintain flood insurance, with many remaining uninsured due to misconceptions about their flood risk. Let’s correct some common myths surrounding flood insurance:

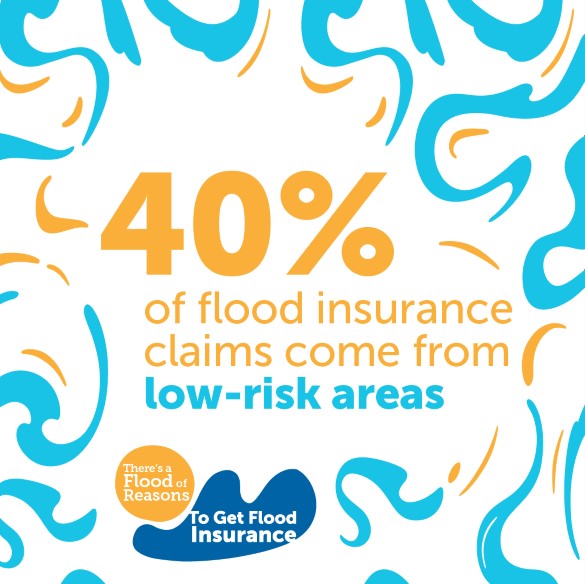

While it’s true that some areas are more prone to flooding than others, you shouldn’t assume you’re safe just because you don’t live in flood zone. Over the last 30 years more than 99% of U.S. counties have been impacted by flooding and more than 40% of NFIP claims come from outside high-risk areas. It’s particularly important to have flood insurance if you live at or near a dam-break inundation zone.

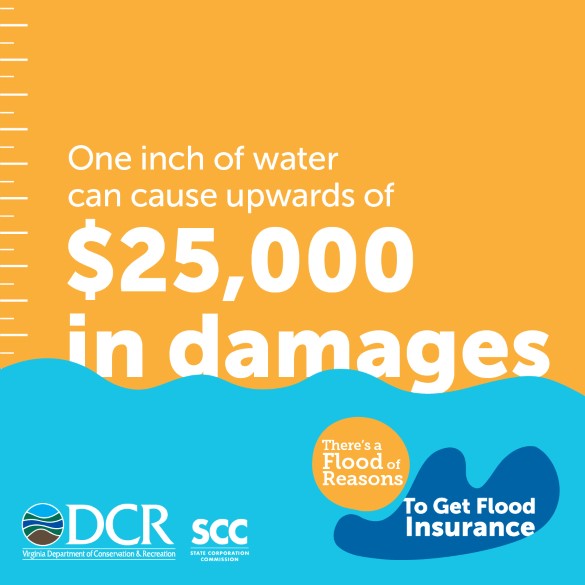

Even a small flood can be financially devastating: just one inch of water can cause upwards of $25,000 in damages, and the average NFIP claim is $66,000, far outweighing the average annual premium of $700. Without flood insurance, you’ll pay those costs out-of-pocket. Your property may qualify for a discounted flood insurance rate if you live in an area of minimal flooding, if you take action to mitigate the effects of flooding, such as elevating your HVAC or your entire home or if your locality participates in the Community Rating System.

Most homeowners or renters insurance policies don’t cover damage to the building or your personal property caused by flooding. To cover flood-related damage, you’ll need to purchase a separate insurance policy. Flood insurance may be available through the NFIP and private insurers. Don’t wait until a storm is forecast to take action: there is a 30-day waiting period before flood insurance takes effect.

Flood insurance is the only way to protect your home, your business and the life you’ve built against the financial devastation caused by flooding.

Input your address into the Virginia Flood Risk Information System (VFRIS) to learn about your property’s flood risk. Find out if you live in a dam break inundation zone by accessing the Dam Safety Mapping Application in DCR’s Open Data Hub.

To learn more about the NFIP and your flood insurance options, visit floodsmart.gov.

Categories

Dam Safety | Dam Safety and Floodplains | Floodplain Management

Tags

dams | flood control | flood resilience